Startup Haven Backgrounder

Venture-scale is different.

Startup Haven is different.

(Here because you’re curious what a Startup Haven poker event looks like? Click here.)

Startup Haven is an exclusive, multifaceted support network for venture-scale startup founders and investors. Our mission is to connect Startup Haven members with education, opportunities and especially, each other. We accomplish this through our in-person and virtual programming as well as through member networking and support programs.

Startup Haven also operates the Startup Haven Ventures Fund, a pre-seed investment fund, and the Startup Haven Accelerator, a pre-seed accelerator program based on the GroundWork Growth framework.

Startup Haven

By the Numbers

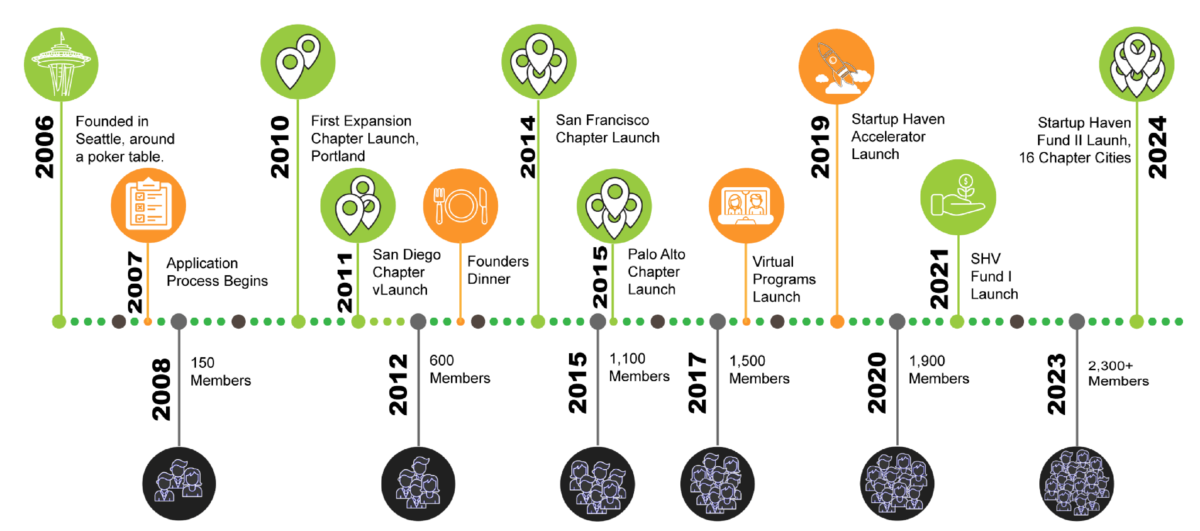

For nearly 20 years, Startup Haven has been helping venture-scale startup founders and investors get connected,

get the help they need and get them through one of the hardest journeys a human can choose.

How We Got Here

Building something great takes time. Startup Haven has always prioritized value over speed, quality of quantity, signal over noise. And we always will.

![Line_Banners-19-[Converted]](https://startuphaven.com/wp-content/uploads/2024/08/Line_Banners-19-Converted-300x110.jpg)

If it’s not valuable to members, we don’t do it.

Venture-scale is Different

Building any kind of company is hard work and every entrepreneur deserves our respect. But building a successful venture-scale company is a different kind of hard; it’s ridiculously hard. In addition to working incredibly long hours, for low (or non-existent) salary, and immense mental stress, venture-scale founders endure all of this, for years, in the face of a 95% failure rate.

When things go well (which they seldom do) founders face the daunting task of raising millions in capital. They might also need to grow a world-class team from 10 to 50 in three months, while competing for the best talent with well-funded tech giants like Google, Amazon and Microsoft. Each milestones they need to reach presents a new existential threat… and everything is at stake for the founders. To be successful, venture-scale founders will need to go through these things (and much more) several times. This is the problem set of venture-scale.

Every founder of every company faces many difficult challenges. But it is highly unlikely that a fledgling bakery or construction company or consultancy will ever face the unique challenges that face venture-scale startup founders. And, unless you have been a founder yourself, it is difficult to truly understand them — and it is impossible to understand the felt experience of the founders who choose to take them on.

So founders face them alone.

This is the “why” of Startup Haven. No one can understand or help a venture-scale startup founder in the way that another venture-scale founder can. Our mission is to help these founders build real relationships so they can help each other.

For more on venture-scale startups, see Anatomy of Venture Startup section below.

The first rule of Fight Club:

you don’t talk about fight club.

If Startup Haven is so great, why haven’t I heard of it?

That’s a very reasonable question to ask.

Historically, Startup Haven has never sought publicity, recognition or accolades. Talking about us (about Startup Haven) did nothing to help our founder and investor members.

In addition, the cost-benefit ratio of promoting Startup Haven had always been a loosing proposition because of the work involved in vetting new members. Only a small percentage of the folks who operate in and around the startup ecosystem are qualified to participate in Startup Haven. As you might imagine, there are many people who are not qualified for Startup Haven membership how would, nonetheless, love to come to a breakfast, a dinner or a poker game replete with founders and investors. So they apply to join. About 85% of applicants who “heard about Startup Haven somewhere” are not qualified to join; but we still had to vet every single one of them. That’s a lot of work. Too much work. So we stopped talking out loud about ourselves.

All this changed in 2020 when we launched the Startup Haven accelerator and venture fund. No longer did it makes sense be the best kept secret — finding the best deal flow for the fund and accelerator required that we leverage our network and platform as broadly as possible. So, finally, we began to actively promote Startup Haven. We also began using data to triangulate on founders and investors who we could know for certain were qualified for membership and reach out to them directly. We began the greatest growth period we had seen to date.

Then came COVID and a three year hiatus for all of the best stuff we do. In late 2023, we began relaunching our live events and picked up where we left off with our growth plans. Since then we have doubled our city chapters and are working to make that a triple soon.

City Chapters

Great companies can be built anywhere.

But the right help cannot always be found everywhere.

City chapters operate in startup cities/regions where we can identify a minimum of 300 startups. Of course, top-tier cities (e.g., SF, NYC, SEA, BOS, etc.) have thousands of startup companies. Membership in city chapters is exclusively for founders and investors who meet our Core membership requirements.

New startup founder members applying for “Core” membership must be working full time on a venture-scale company and must have achieved at least some early elements of progress.

New investor members applying for “Core” membership must attest that they are actively seeking their next venture-scale startup investment and are asked to provide a reference to one of their portfolio founders.

Communities of Stakeholders

It takes a village.

But not just any village.

In 2022, Startup Haven launched our Community Chapters program to support venture-scale entrepreneurship in smaller and nascent startup communities. While the number and scope of startups, founders and investors in these burgeoning regions may not rival the likes of Silicon Valley and New York, the entrepreneurial spirit burns just as bright.

By engaging with the broader startup ecosystem and providing a focal point and resources for venture-scale entrepreneurship, we offer a platform for all stakeholders to accelerate the growth of their ecosystem.

- Venture Capital Firms (network and portfolio support)

- Angel Groups (deal flow, member recruitment)

- Local Community Leaders (collaboration)

- Economic Development Organizations (growth/jobs initiatives, revenue, reputation)

- Corporate Innovation Partners (awareness, deal flow, recruiting)

- University Entrepreneurship Programs (student opportunities, recruitment)

- Service Providers (technology, legal, banking, financial services, real estate, etc.)

- Aspirational Startupers (founders and investors who do not yet meet our requirements)

By engaging the broader community of stakeholders in these up-and-coming ecosystems, Startup Haven can help grow the foundation of a more-vibrant venture-scale ecosystem.

Peer-to-Peer Support Programs

Startup Haven’s greatest asset is its members. With more than 2,300 founders and investors, there is virtually no aspect of the startup journey that at least some of our members have not experienced. And they want to share that experience with others. Our peer-to-peer programs are how we enable our members to help each other.

Startup Poker 2.0

Literally the best networking activity for founders and investors on planet earth.

It is impossible to fully convey the brilliance of this event in a paragraph. So here are three articles that will get you there.

Founders Dinner

A room full of founders and investors and a no-pizza rule. What’s not to love.

It’s rare to attend an event where you would welcome a conversation with every person in the room. In Core chapters, all attendees are vetted venture-scales founders and investors. In Community Chapters, a limited number of non-Core members are invited to attend as well.

Venture Breakfast

Whether its one table or one room… it all founders, it’s informal and it’s raw.

Breaking bread, early in the morning, among peers, is a remarkable environment. Rapport is immediate, the conversations are intimate and the connections are real. Venture Breakfasts are the straightest line to relationships between founders.

Member Brief

With 2,500+ experienced founders and investors, chances are that our members have seen it all. Literally.

That’s a lot of knowledge to share. To help with that, we offer to provide founders and investors with a platform to capture the wisdom and knowledge they most want to share. For some of our most-experienced and most-sought-after members, it can be especially hard to share insights “out in the wild.” Member Briefs provides them a way to help at scale.

Ask & Offer

Our online Ask & Offer platform allows Core founder and investor members can get and give help among the entire Startup Haven ecosystem.

Member Office Hours

Book some time with other experienced Startup Haven members who volunteer to share their time with you. While you’re at it, volunteer some of your time to help other Startup Haven members with topics within your own area of expertise.

Vouch Recruiting

There is no harder challenge for startup founders than building a world-class team. Besides just finding great people, startups must compete with big-tech comp packages and employee perks that are out of their reach. We can’t solve that problem entirely but we can leverage the Startup Haven community of founders and investors to tap into the thousands of personal networks of our members to help find great people.

Expert-led Support Programs

Startup Haven’s greatest asset is its members. With more than 2,300 founders and investors, there is virtually no aspect of the startup journey that at least some of our members have not experienced. And they want to share that experience with others. Our peer-to-peer programs are how we enable our members to help each other.

GroundWork Growth Workshops

In these interactive virtual sessions, founders present their strategic milestones for an exploration of their cogency — i.e., is it the right, next milestone? Would investors agree? What does the milestone unlock, what needs to be true in order to reach it, and what assumptions underlie it? We will use the principles used in the GroundWork Growth methodology, the curriculum taught in the Startup Haven Accelerator program.

Capital Strategy Workshops

Fundraising is hard. A slick pitch deck and a confident story is seldom enough, even in the best of times. And we are not in the best of times.

This interactive workshop dives into the key decisions every founder must make in order to run an efficient fundraising process and maximize their chances for success — when to raise, who to raise from, how much to raise, and at what valuation. We will also explore how investors think and the essence of investor diligence.

Advisor Office Hours

Our partners provide one-on-one expert advice in a number of areas: legal, financials, fundraising, intellectual property, real estate, and more.

Pitch Coaching

Startup Haven Pitch Coaching sessions are not just pitch deck feedback. We go deep. Presenters decide what to focus on and then get in-depth, no-nonsense advice from experienced founders and investors — what’s good, what’s bad and what can make it better.

Lunch and Learns

Our partners offer focused content tailored to the needs of venture-scale startups. These sessions are recorded and made available to all Startup Haven members. Since 2020, these sessions have been conducted virtually. Live Lunch and Learns may return in the future.

Partnerships

Partnerships are a vital aspect of how we support startup founders, investors and communities. In all cases, we seek win/win/win partnerships support our members, our partners and our mission.

Service Providers

Our service provider partnerships help our members triangulate on high-quality providers who understand the venture-scale startup journey. Our partners benefit from connecting with our network and provide access to highly-relevant information and education. For more information on how to work with Startup Haven as a service provider partner, email us at [email protected].

Economic Development

Startup Haven partners with economic development agencies and other organizations to support efforts to foster innovation in their ecosystems. Our programs and resources are tailored to the specific needs of each community; but with the mission of helping to connect startup founders with each other as well as with investors and other stakeholders. As venture capital organization, we also seek to provide funding, mentorship, and expertise to grow startups.

To achieve this, we work with our economic development partner to:

- Identify, attract and retain potential high-growth startups by creating a more supportive ecosystem for entrepreneurship and innovation.

- build more and stronger local relationships between startups, investors, and economic development agencies.

- connect economic development agencies with other cities, allowing them to share best practices and knowledge.

- leverage relationships with startups and investors in other cities is that it provides access to a wider pool of expertise and resources.

- Engage, support and expand their communities angel investor ecosystem.

For more information on how we can help support your local ecosystem, email us at [email protected].

Appendix 1: Anatomy of a Venture Scale Startup

There are some grey areas and some outliers, but venture-scale startups can generally identified by the following criteria.

- Venture-scale startups progress along a trajectory of traction. Not every venture-scale startup passes through all stages; but if a startup, in principal, is unlikely to pass through most of them then it is unlikely to be venture-scalable.

- Product: idea stage, MVP, production

- Revenue: pre-revenue, first customer, profitability

- Funding: bootstrap, pre-seed/seed, Series A, B, C+

- Liquidation: merger, acquisition, IPO

- Venture-scale startups are predominantly product companies, not services companies. I.e., venture-scale companies rarely delivery their principal customer value by paying humans to perform work for others.

- Venture-scale startups have an intended trajectory of significant scale — e.g., aiming for national or global reach and/or aiming to provide a product or service to a significant market (typically valued in the hundreds of millions to billions of dollars.) There are some exceptions, but they are rare.

- Venture-scale startup founders are typically not well compensated while building their companies. Instead, they are incented to build a company of great value that produces an out-sized outcome in the future (typically through a liquidity event such as a merger, acquisition or IPO, but also sometimes through immensely scaling revenue.)

- Venture-scale startups need never raise venture capital, however the company is recognizable by investors as, in principle, investable. This usually means companies that can scale to millions in monthly revenue, grow to tens of millions in annual revenue and/or produce liquidity events in the range of tens of millions, hundreds of millions… and possibly even one billion or more.